If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax WEG label you need further information to claim GST credits and for it to be considered a valid tax invoice. As of 1 January 2009 thin.

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

All income accrued in derived from or.

. Tax invoices sets out the information requirements for a tax invoice in more detail. If a response is required and you do not provide a valid email address we will not be able to reply to your inquiry. An estimated 50 of Irans GDP was exempt from taxes in FY 2004.

There are virtually millions of. Malaysias taxes are assessed on a current year basis and are under the self-assessment system for all taxpayers. An overview about Malaysia Taxation where all businesses need to pay income tax and other taxes depending on the business nature under Malaysia taxation.

When you contact the Division of Taxation through the website we respond by email. Taxable and non-taxable sales. GSTR 20131 Goods and services tax.

9 units with the TA prefix that are not a part of the programs core course requirements. Federal Income Taxation of Partners and Partnerships TA 329 Tax Research and Decision Making TA 330 Property Transactions TA 338 Tax Timing ELECTIVES 9 UNITS. If eligible students may take TA 398 Internship.

However money paid to other causes in the name of other religions under similar circumstances is given only income tax relief and such relief is given only if the particular. The current principal direct taxation legislation consists of the following. Including those listed on Bursa Malaysia cannot be carried forward.

Issues of interest restriction and allocation can arise when a company has an interest expense and a variety of income-producing and non-income-producing investments. In Malaysia there is a rebate in income tax for money paid to the government in form of zakat or the obligatory alms Muslims must give to the poor. As of April 29 2022 PwC firms in the territories listed below sold their Global Mobility Services businesses to Vialto Partners.

Key Issues And Ambiguities. Please check your email address carefully before you send your message. Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of IranIn 2008 about 55 of the governments budget came from oil and natural gas revenues the rest from taxes and fees.

The PwC firms in those territories participated in that sale and no longer provide Global Mobility Services. Generally the following types of dividends are exempt from taxation in Malaysia-Dividends from Malaysia companies to its shareholders with effect from 1 January 2014 all companies will be on the single-tier system and all dividends received will be exempted from tax in the hands of the shareholders.

Impacts Of Covid 19 On Firms In Malaysia Results From The 1st Round Of Covid 19 Business Pulse Survey

After 25 Years Of Trying Why Aren T We Environmentally Sustainable Yet Sands Singapore Singapore Environment

Tax Haven Offshore Bank Developing Country

2022 53 Uncertainties In Malaysia S Economic Recovery By Cassey Lee Iseas Yusof Ishak Institute

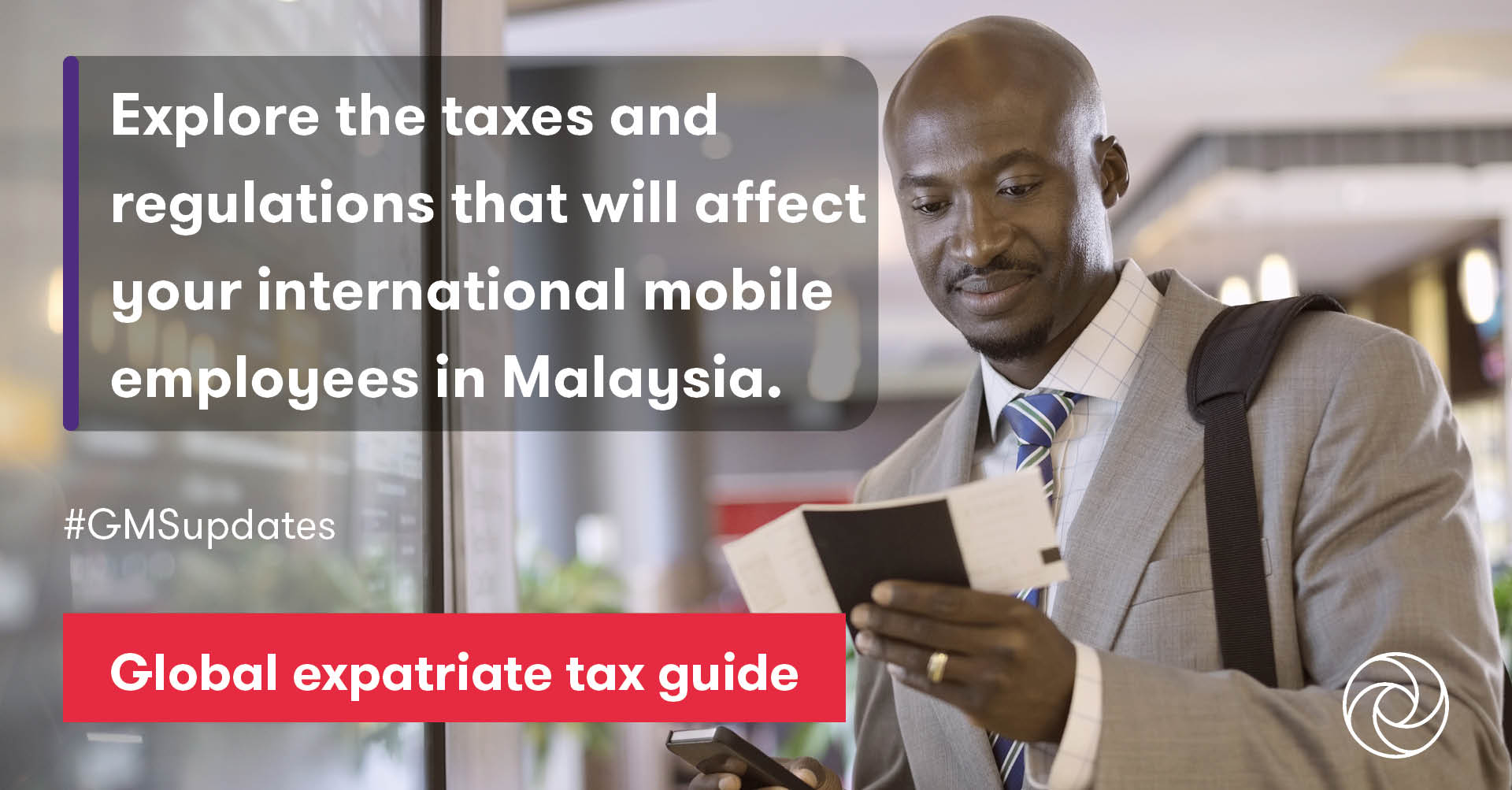

Expatriate Tax Malaysia Grant Thornton

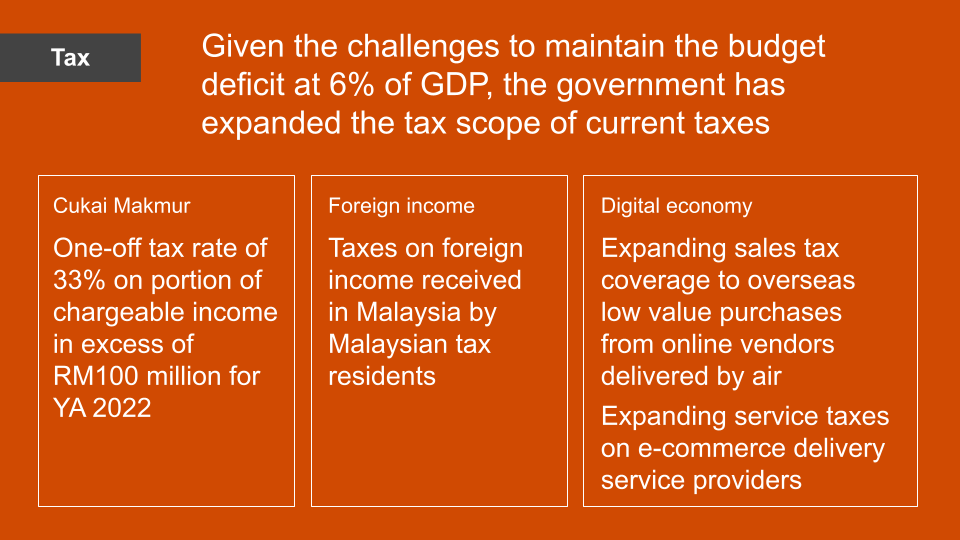

Malaysia S Budget 2022 Key Takeaways For Employers And Hr To Note

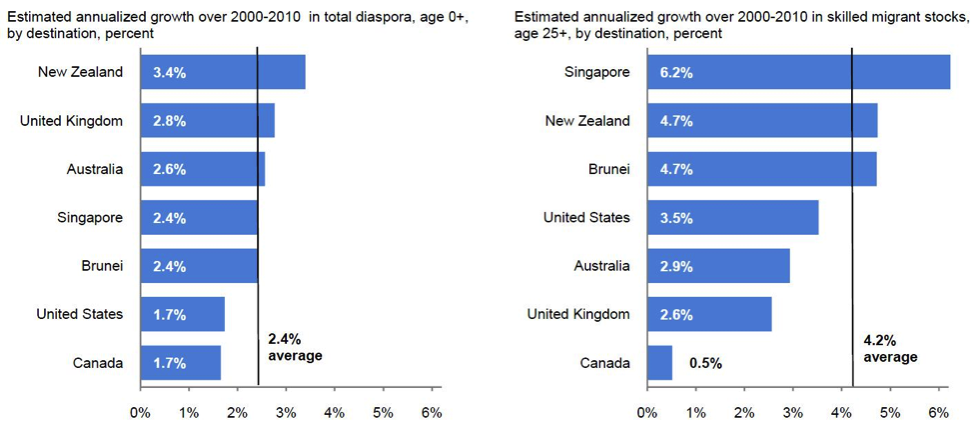

Putting The Malaysian Diaspora Into Perspective

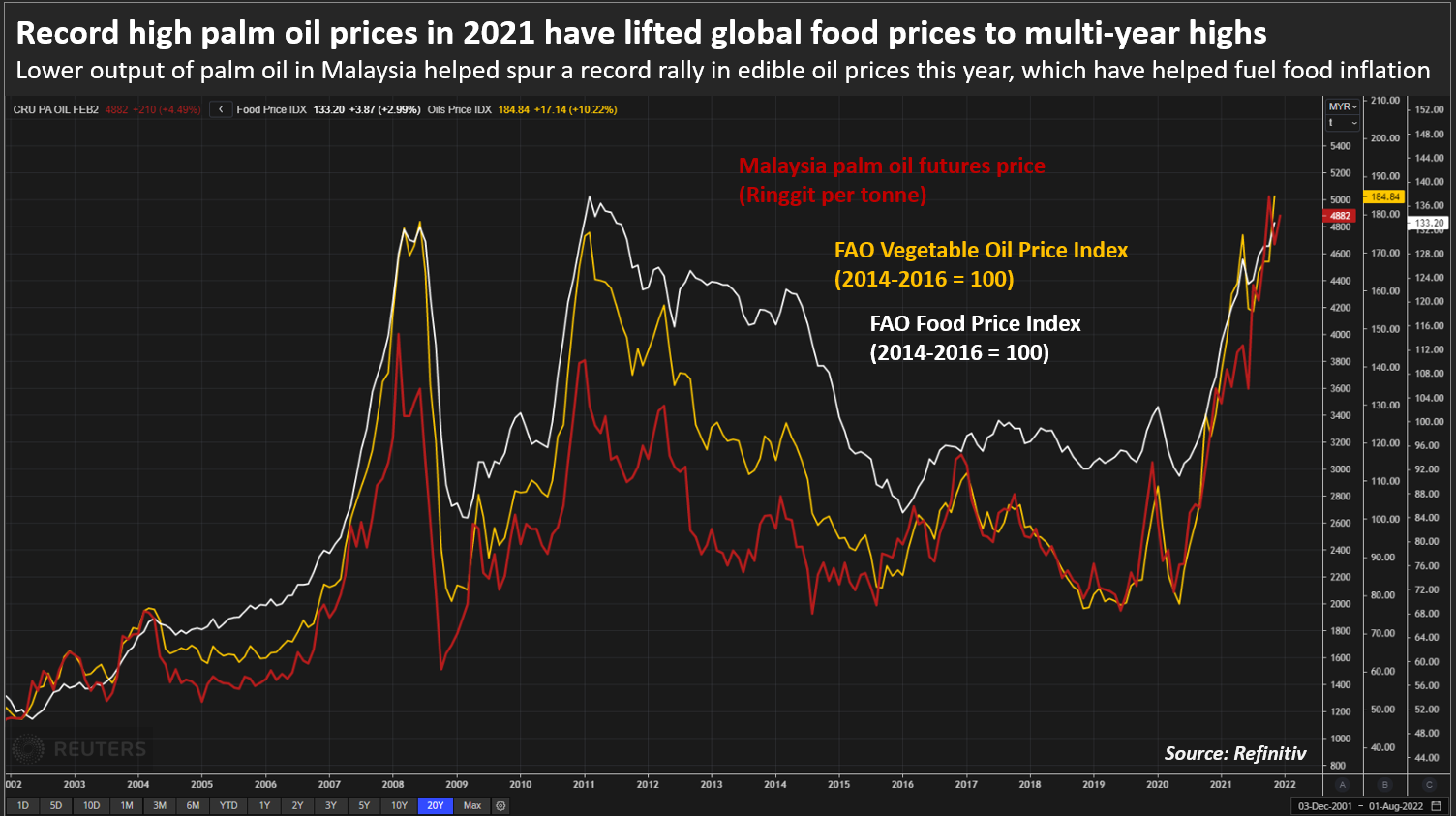

Analysis Malaysia S Palm Oil Producers Adjust To Labour Shortages Higher Recruitment Costs Reuters

Malaysia Issues Tax Exemption For Foreign Sourced Income

Pilot Calls For Search For Hijacked Mh370 Around Madagascar Indonesia Jakarta Pilot Andaman Islands

11 Contoh Resume Pupil Uitm Resume Template Resume Job Resume Template

A Quick Understanding On Taxability Of Foreign Sourced Income Crowe Malaysia Plt

Best Steps To Financial Planning Best Kindle Books Unlimited Investing Assistance You Are Able To Put Into Practice Now Investing Financial Planning Best Kindle

/cloudfront-us-east-2.images.arcpublishing.com/reuters/SQ2RZSFVLNN23BTMEZHRQEX7BI.png)

Analysis Malaysia S Palm Oil Producers Adjust To Labour Shortages Higher Recruitment Costs Reuters

Malaysian Tax Issues For Expats Activpayroll

Malaysian Tax Issues For Expats Activpayroll

Pressure To Raise Taxes Anticipated The Star

Pin On Blogging Consumerism Social Issue Politics